Financial Aid Handbook

Use (Ctrl + F) to search in Financial Aid Handbook.

Student Eligibility Requirements for Federal Financial Aid

How Do I Obtain Financial Aid?

The California College Promise Grant (CCPG)

How Do I Manage My Financial Aid Refunds?

Financial Aid Policy & Conditions of Financial Aid Award

Rights and Responsibilities for Financial Aid Programs

Special (Unusual) Circumstances

Conflicting & Inaccurate Information

Financial Aid Conflict of Interest Policy and Code of Conduct

Satisfactory Academic Progress

Student Grievances and Appeals

What’s New in Financial Aid

Enrollment Status for Federal Pell Grant

Understanding Enrollment Status and Financial Aid Eligibility

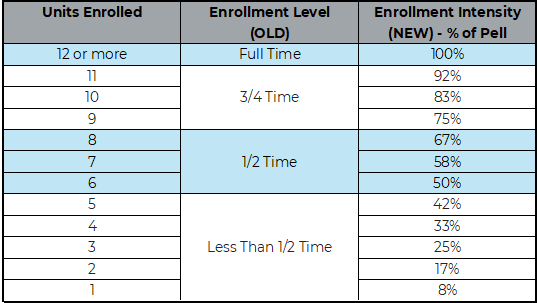

Your enrollment status, or the number of units you are taking, plays a significant role in determining your eligibility for financial aid. Starting in the 2024-2025 award year, the way your Pell Grant eligibility is calculated is changing from the old system of enrollment level categories to a new approach called “enrollment intensity.” Instead of the previous classifications like “full-time,” “three-quarter time,” “half-time,” and “less-than-half-time,” your Pell Grant award will now be determined based on your enrollment intensity.

What is Enrollment Intensity?

Enrollment intensity is a percentage that represents how many units you are taking compared to a full-time course load. Your Pell Grant award will now be calculated based on this enrollment intensity percentage, rather than the old enrollment level categories. This new enrollment intensity system provides a more flexible and accurate way to calculate your Pell Grant, tailoring the award amount to your actual enrollment level rather than fitting into broad categories. Please keep in mind, the chart below is only for the Federal Pell Grant, other aid, such as CalGrant, will still use the old system of Enrollment Level to award (Full-time, 3/4 Time, 1/2 Time, etc) See chart below:

What is the maximum Federal Pell Grant for the 2025/2026 aid year?

The Maximum Pell Grant for 2025/2026 is $9,292 for the entire year (If enrolled in 12 or more units for Fall and Spring AND Student Aid Index (SAI) is between –1500 and 0). Adjustments will be made based on actual enrollment and SAI. The Student Aid Index (SAI) is what the FAFSA calculates based on your income and household information reported on the FAFSA.

As of August 2021, students can now submit documents in person. Students must show a picture ID when submitting documents. Check the colleges website for the hours the Financial Aid Office is open. Students can still submit documents using DropBox. Follow the instructions below.

Submit documents securely with DropBox

Ensure your student ID number is on every document you are uploading

1. Go to the DropBox link

2. Click on the Choose files button and locate the file(s) you want to submit

a. *Include your student ID number to your filename

b. In the First name field, *ENTER YOUR FIRST AND LAST NAME

c. In the Last name field, *ENTER YOUR STUDENT ID NUMBER

d. Enter your Email address for a confirmation

e. Click on Upload button

*Instructions to ensure we can identify your documents and link them to your financial aid file

New State Legislation Passed

AB2416- If you have not met the District’s Satisfactory Academic Progress standards, have been disqualified from financial aid, and are experiencing homelessness we encourage you to appeal. Your housing insecurity will be taken into consideration when reviewing your appeal

SAP

The Satisfactory Academic Progress (SAP) calculation for students that receive an EW due to COVID-19 on or after 03/17/20, will have the quantitative measure pace rate excluded. These units will also not be counted in calculating maximum time frame. When the pandemic ends, EW grades will be included. An EW grade does not automatically qualify you for a COVID related withdrawal for financial aid purposes.

Example: A first-year student took 10 units in the Fall 2019, but only passed 7 units.

At the start of Spring 2020, the student is at a 70% completion rate; student is in

good standing for financial aid.

The student takes 10 units in Spring 2020, but due to COVID-19, the student takes

an EW grade in 5 units.

For quantitative measure (total earned units/total attempted units), the Financial Aid Office will count the Fall 2019 and the Spring 2020 units without the 5 units from the EW grades.

If this student completes the Spring 2020 with 5 units (excluding the 5 EW units), the student’s completion after Spring 2020 is 12 out of 15 units or 80% cumulative completion rate. Student is in good standing because they remain above the cumulative 67% completion rate. If the EW was part of the calculation, then the student would have failed SAP because it would have been 12 out of 20 units or 60%.

Students should contact the Financial Aid Office if they are approved for a COVID related withdrawal for a prior term.

R2T4

On March 27, 2020, the Coronavirus Aid Relief, and Economic Security Act (CARES) was passed which provided emergency flexibilities and regulatory relief for institutions of higher education and their students.

Return of Title IV (R2T4) requires students who receive federal financial assistance and completely withdraw from all classes before completing more than 60% of the semester to return any unearned federal funds. The amount of the repayment will be calculated on a pro-rata basis of the number of calendar days in the term. Pell Grant, FSEOG and Federal Direct Student Loans (Title IV federal financial aid) will be included in the calculation. Due to the disruption caused by COVID-19, requirements for students and schools to return unearned federal grants or loans to the Department of Education was waived for the Spring 2020 term. Beginning in the Summer 2020 term, students whose withdrawal is COVID related are required to complete an attestation indicating the reason for their withdrawal. If approved, the waiver may be applied.

All Federal Student Loans Held by the Federal Government—Zero Interest and Suspension of Payments

In response to the COVID-19 national emergency, zero interest will accrue on student

loans held by federal government agencies for at least 60 days beginning on March

13, 2020.

The CARES Act extended the interest reprieve and implemented an automatic forbearance until August 31, 2022, for any borrower with a student loan held by the Department of Education.

Note: AB 2747 (Nazarian) Public postsecondary education: tuition and fees: Team USA student athletes. The purpose of this bill is to ensure a Team USA athlete who is currently residing in California for purposes of Olympic training will be exempt from the payment of the nonresident tuition fee. This bill provides resident classification (in-state tuition) to any Team USA student athlete, as defined, who trains in California in an elite level program approved by the U.S. Olympic and Paralympic Committee. This bill requires the student athlete to certify their participation in an Olympic or Paralympic elite level training program through supporting documentation from the U.S. Olympic and Paralympic Committee and to submit that documentation to the campus Registrar: Skyline College, Cañada College, College of San Mateo

Cal Grant B Eligibility Expansion for Foster Youth

Foster youth students are able to renew their Cal Grant B awards, while attending full time in an undergraduate program with an equivalency total of eight years. Eligible students are those who have been certified by the California Department of Social Services (CDSS) and have an active Cal Grant B award.

Foster Youth Cal Grant B High School Entitlement Eligibility Expansion

Cal Grant B High School Entitlement Award eligibility consideration will be given to current or former foster youth students attending a California Community College who have applied no later than September 2nd of the academic year of enrollment. Also, a student has not reached 26 years of age as of July 1st of the initial award year and a qualify high school GPA or test score has been submitted regardless of graduation date, or the equivalent.

*Note: Current or former foster youth for this program is an individual whose dependency was continued or established by the court on or after the date on which the individual reached 13 years of age.

Cal Grant A and C updates

Cal Grant A recipients attending a California Community College are now eligible for an Access Award similar to Cal Grant B.

Cal Grant A and B recipients with dependent children under 18 years of age for whom they provide more than 50% support can qualify for an increased Access Award of up to $6,000.

Cal Grant C Books/Supplies award will increase to a maximum of $4,000.

Community College Student Success Completion Grant (SSCG)

Students must be eligible for the Cal Grant B or the Cal Grant C and enroll in 12 or more units each term. Students must also maintain and follow a current Student Education Plan and be making Satisfactory Academic Progress.

- Enrolled in 12-14.99 units receive an additional $649 per semester (max of $1,298 per year).

- Enrolled in 15+ units receive an additional $2,000 per semester (max of $4,000 per year).

You can get more information regarding the Student Success Completion Grant on Skyline’s, College of San Mateo’s and Cañada’s financial aid web sites.

Pell Grant

|

|

2024-25 |

2025-26 |

|

Pell Grant Award Amounts |

$7,395 |

$7,395 |

|

Maximum SAI |

6206 |

6656 |

*Students are limited to a 600% Pell Grant lifetime eligibility (equivalent to 12 full-time semesters/6 years of full-time enrollment). To view your Lifetime Eligibility Used (LEU), please visit https://studentaid.gov/fsa-id/sign-in/landing

https://studentaid.gov/understand-aid/types/grants/pell

District Loans Interest Rates

|

Academic Year |

2024-25 |

2025-26 |

|

Interest Rate |

7.54% |

6.39% |

https://studentaid.gov/understand-aid/types/loans

Satisfactory Academic Progress (SAP) Online Workshops

If you are required to appeal, please complete the online “GetSAP” Financial Aid Counseling Sessions through our Financial Aid TV website. Make sure to print your certificate of completion once you successfully finish The Essentials to Understanding Satisfactory Academic Progress (SAP) and What it Means to You and The Key Components to the Satisfactory Academic Progress (SAP) Financial Aid Appeal Process sessions.

- Skyline College- https://skylinecollege.get-counseling.com

- College of San Mateo- https://collegeofsanmateo.get-counseling.com

- Cañada College- https://canadacollege.get-counseling.com

BankMobile Disbursements Financial Aid & Scholarship Refunds

The San Mateo County Community College District (SMCCCD) delivers your refund with BankMobile Disbursements, a technology solution, powered by BMTX, Inc. Find out more about how BankMobile Disbursements works.

Student Eligibility Requirements for Federal Financial Aid

Have a high school diploma or GED or the equivalent.

Be enrolled in an eligible program leading to an associate degree, certificate, or transfer toward a university at any of the colleges in the San Mateo County Community College District (SMCCCD).

The Emergency Medical Technician (EMT) certificate program is NOT an eligible course of study for federal and most state financial aid.

Be a U.S. citizen or eligible non-citizen*. Note: Some State of California programs may have a less restrictive citizenship requirement for non-U.S. citizens.

Have completed the enrollment process which involves assessment, college orientation, and completion of a Student Educational Plan (SEP) with a counselor.

Submit all required forms and documents requested by the Financial Aid Office and/ or Department of Education.

Meet and maintain Satisfactory Academic Progress (SAP) requirements as defined by the SMCCCD colleges in the Financial Aid Handbook.

Have financial need (except in the case of unsubsidized federal loans) as demonstrated by a completed FAFSA (available online at fafsa.gov)

Register with the Selective Service if you are a male between 18 and 25 years of age.

Do not owe a refund or repayment on a federal grant.

Not be in default on a federal educational loan or owe a repayment to a federal grant program.

Supply an accurate Social Security number and name. (If you are a dependent student, your parent is not required to have a valid Social Security number.)

Not have a conviction for a drug-related crime (possession or sales) that occurred when you were receiving federal aid.

Students with a Bachelor’s Degree are not eligible for Pell Grant or Federal Supplemental Educational Opportunity Grant funds but may be eligible California College Promise Grant (CCPG) fee waiver, Federal Work-Study and/or Federal Direct loans.

Eligible Non-Citizen: US Permanent Residents with a Permanent Resident Card (I-551) or Conditional Permanent Residents (I-551C) or those with an Arrival-Departure Record (I-94) showing the designations of Refugee, Asylum Granted, Parole or Cuban-Haitian Entrant; or those with an Immigration Court document approving Asylum or documentation of entering the U.S. under provisions of the Victims of Trafficking and Violence Protection Act may be eligible for federal financial aid.

How Do I Obtain Financial Aid?

Fill out the Free Application for Federal Student Aid (FAFSA) or California Dream Act Application (CADAA).

Complete the Free Application for Federal Student Aid (FAFSA) if you are a US Citizen or Permanent Resident at www.fafsa.gov.

Get your FSA ID at studentaid.gov/h/apply-for-aid/fafsa to start and complete your FAFSA.

One parent of dependent students will need their own FSA ID to electronically sign the FAFSA. Parents that do not have a Social Security number can print, sign and mail a signature page.

Be sure to save the FSA ID information, as it will be used for all federal aid and loan processing.

Complete the California Dream Act Application (CADAA) if you are an AB 540 and/or DACA student at dream.csac.ca.gov/landing.

1. Wait for Notification

Once your FAFSA application is processed, you will be notified by email at the address you listed on your FAFSA.

There is a link to view your FAFSA information. Review the comments to see if more information or corrections are needed and to confirm the schools you listed when you completed the form.

If you do not receive this email within 1 to 3 days, it may mean your FAFSA data was saved but not submitted to the processor. Log back in to www.fafsa.gov and submit.

If you have questions while completing the FAFSA call 800-433-3243 for help. (TTY 1-800-730-8913)

2. Complete your SMCCCD Documents

Once your SMCCCD college receives your FAFSAA or CADAA, you will be able to check WebSMART under the “My Eligibility” link under the “Financial Aid” tab. An automated email will also be sent to your primary email (usually your college issued email) advising you to check WebSMART to see if additional requirements are needed to complete your file. Follow the instructions below to submit documents to the Financial Aid Office. Once your file is complete, your SMCCCD Financial Aid Office will be able to determine your financial aid program eligibility.

Submit documents securely with DropBox

Ensure your student ID number is on every document you are uploading

1. Go to the DropBox link

2. Click on the Choose files button and locate the file(s) you want to submit

a. *Include your student ID number to your filename

b. In the First name field, *ENTER YOUR FIRST AND LAST NAME

c. In the Last name field, *ENTER YOUR STUDENT ID NUMBER

d. Enter your Email address for a confirmation

e. Click on Upload button

*Instructions to ensure we can identify your documents and link them to your financial aid file

3. Investigate Other Options

After you are notified of your financial aid, you should also investigate other opportunities and support services. Additional campus resources can include EOPS, CARE, TRiO Student Support Services, SparkPoint, Internships, and Scholarships. More information may be found later in this document.

The California College Promise Grant (CCPG)

The State of California offers a CCPG for students who are residents of the State of California and who are eligible for need-based financial aid. The CCPG pays your enrollment fees for the academic year once eligibility has been determined. Other fees, such as the health, materials, parking, student body, and student representation fees must be paid by you. Students with the CCPG are eligible for a reduced rate parking permit.

It is strongly recommended that you complete the FAFSA or CADAA for the CCPG program to see if you are eligible for additional financial assistance. CCPG-only applications are available on-line through WebSMART. You must be admitted to Cañada College, College of San Mateo, or Skyline College before you can access WebSMART. Eligibility for a CCPG may be determined under less strict dependency criteria than federal funding requires (example: a 19-year-old student who is unmarried and does not support anyone may be considered independent for the CCPG if s/he was not claimed on the parent’s federal income tax during the previous year and no longer lives with a parent).

There are Five Types of CCPG:

CCPG-A: If you are independent, to be eligible you must be currently receiving TANF, CALWORKS, General Assistance, or SSI/SSP, or if you are dependent, your parent(s) must be currently receiving any of these types of assistance. You are required to submit proof of benefits to the Financial Aid Office within 21 days of submitting your electronic application.

CCPG-B: To be eligible you must meet the State defined Income Limits. The 2024-2025 income standards listed on the left are based on income for the 2022 tax year. The 2025-2026 income standards are listed on the right and are based on 2023 income.

If you are independent, use your income (and spouse’s) only. If you are dependent, use your parents' income only.

|

Family Size |

Total 2022 Income | Total 2023 Income |

|

1 |

$21,870 or less | $22,590 or less |

|

2 |

$29,580 or less | $30,660 or less |

|

3 |

$37,290 or less | $38,730 or less |

|

4 |

$45,000 or less | $46,800 or less |

|

5 |

$52,710 or less | $54,870 or less |

|

6 |

$60,420 or less | $62,940 or less |

|

7 |

$68,130 or less | $71,010 or less |

|

8 |

$75,840 or less | $79,080 or less |

|

|

** Add $7,710 for each additional dependent. | ** Add $8,070 for each additional dependent. |

CCPG-D: If you are a homeless youth defined by Section 725 of the federal McKinney-Vento Homeless Assistance Act, then you will be eligible for the fee waiver. You may be required to complete the Homeless Youth Certification Form and submit to either the Financial Aid Office or Admissions & Records Office.

“Homeless youth” means a student under 25 years of age, who has been verified homeless or at risk of homelessness at any time during the 24 months immediately preceding the receipt of his or her application for admission.

CCPG-C: Must demonstrate at least $1,104 of need by filing the FAFSA or CADAA for the appropriate aid year.

Note: EOPS requires students to be either CCPG-A or -B eligible, or after filing the

FAFSA or CADAA have an Expected Family Contribution (EFC) of 0 to receive their services.

CCPG – Special Classification:

If you meet any of the following criteria, you may be eligible for a fee waiver under the Special Classification guidelines. Certification is provided by various agencies. Please contact your SMCCCD college Financial Aid Office for assistance:

- Eligible dependent of deceased or disabled veteran

- Recipient of the Congressional Medal of Honor or dependent

- Dependent of California National Guard

- Dependent of victim of September 11, 2001 terrorist attack

- Dependent of deceased California law enforcement/fire suppression personnel killed in the line of duty

- Students who have been exonerated

Apply for the online California College Promise Grant (CCPG) Fee Waiver in WebSMART.

Loss of CCPG and Priority Enrollment Regulation:

California College Promise Grant

Part-time and full-time students may qualify for the CCPG. The CCPG fee waiver will waive enrollment fees for the academic year. Other fees, such as parking, textbooks, student body and student representation fees will not be covered by the CCPG. Recent eligibility regulations went into effect as of the fall 2016 semester requiring all California community college students to meet minimum academic and progress standards and maintain eligibility for the CCPG (SB 1456 Student Success Act of 2012)

Students must:

- Maintain a cumulative GPA of 2.0 (Academic Standard)

- Successfully complete more than 50% of all units attempted (Progress Standard)

If a student is placed on academic and/or progress probation for two consecutive primary terms (fall or spring semester), they will lose CCPG eligibility and priority enrollment. For more information on this regulation and the conditions by which students can appeal, please see http://smccd.edu/faprobation/. Students are encouraged to utilize the numerous support services on campus to help them regain good academic standing.

CCPG - Skyline College Respiratory Care Bachelor’s Degree:

Students accepted into the Bachelor of Science Respiratory Care program at Skyline College will pay $130/unit for upper division coursework. If eligible for the CCPG, $46/unit will be waived and students will be responsible for the remaining $84/unit. To qualify, student must complete a FAFSA (Free

Application for Federal Student Aid) or a CADAA (California Dream Act Application).

How Do I Manage My Financial Aid Refunds?

All financial aid funds are disbursed on scheduled dates each term. As long as you are enrolled in an eligible program and your file is complete, you will receive two disbursements of federal grant aid each semester, based on your enrollment level and classes actively in session. If you are enrolled in a late start class that increase your eligibility for aid the additional funds will be paid when your attendance begins. Federal grant aid includes the Pell Grant and Supplemental Educational Opportunity Grant. Federal Direct Loans are also disbursed in two payments based on the approved loan period. Cal Grant and Student Success Completion Grant funds will be disbursed after census which is approximately the fourth week of the semester. Intersession courses are considered part of the following primary semester for financial aid purposes. The number of units taken during the intersession is combined with the number of units taken during the next following primary semester– together, they will determine your financial aid award and disbursement. If you decide to withdraw from an intersession course, that course may not be counted in your financial aid. Primary semesters are defined as Fall and Spring. Courses added after census are not counted.

Example: TEAM 195 – Women's Basketball Theory begins December 19, 2023. This course begins after the Fall semester but begins before the Spring semester. This course will be considered as part of the Spring semester course load for financial aid purposes.

The enrollment status of students for financial aid awarding and disbursement purposes is finalized at the census date of the semester as long as the college has a valid financial aid application (FAFSA/CADAA) on record. Dates are noted on the college’s academic calendar. At that time, the actual amount of Pell Grant is determined for each student. Courses that are added or adjusted after census are not counted towards a student’s enrollment for financial aid awarding and disbursement of the Pell Grant or other Title IV funds (i.e. SEOG) and state aid such as Cal Grant. This applies to all courses including late start, short-term, and variable unit courses. Pell awards are recalculated when there is a change in the SAI.

Access your Award Letter:

- Login to WebSMART

- Choose the Financial Aid Menu

- Click on My Award Information

- Click on Award By Aid Year

- Select aid year and click submit

Click on Award Overview tab

Acceda a “My Award Information”:

- Iniciar sesión en WebSMART

- Haga clic el Menú de Ayuda Financiera

- Haga clic en My Award Information

- Haga clic En Año de la Ayuda

- Seleccionar el año de ayuda y haga clic en enviar

- Haga clic en Award Overview

*Amounts listed on your Award letter are based on full-time enrollment status. The amount disbursed will be prorated based on your actual enrollment.

BankMobile Disbursements Financial Aid & Scholarship Refunds

The San Mateo County Community College District (SMCCCD) delivers your refund with

BankMobile Disbursements, a technology solution, powered by BMTX, Inc. For more information

about BankMobile Disbursements, visit BankMobile Disbursements Refund Choices.

Please Note: If prompted to enter your school name, use San Mateo County Community College District. We are enrolled with BMTX, Inc. as a college district, not as three separate colleges.

Terms of Agreement

For additional information, view our third-party servicer contract for refund management

Financial Aid Policy & Conditions of Financial Aid Award

The Financial Aid Offices within the San Mateo County Community College District (SMCCCD) at College of San Mateo, Cañada College, and Skyline College, highly recommends for students who receive a federal and/or state financial aid award to read this notification.

If you have questions, please contact your college’s financial aid office.

Financial Aid Award Payment Level Determination:

Students awarded federal or state financial aid funds – including Pell Grants, Supplemental Educational Opportunity Grants (SEOG), Direct Loans, Cal Grants and other associated awards – will have their payment level determined by the number of units they are currently attending at the time of disbursement.

Students enrolled in late starting classes will receive additional disbursements as those late starting classes begin.

Direct Loans will disburse once the student is enrolled and attending at least six units of coursework required for their program of study.

Financial Aid Award Scheduled Disbursement Dates:

Students awarded federal and state financial aid will see the scheduled disbursement dates for each awarded fund in WebSMART under the Financial Aid tab by award year. The disbursement date is the date the colleges initiate the process of applying financial aid and scholarship funds to the student’s account. The actual date funds are issued to students is called the refund date and it occurs after the funds are transferred to our third-party disbursement servicer, BankMobile Disbursements, a technology solution, powered by BMTX, Inc. This generally occurs within 3 business days after the disbursement date.

- Pell Grant and SEOG funds are scheduled to disburse twice each semester, the first disbursement occurs at the beginning of the term and the second disbursement approximately the fourth week of the semester.

- Cal Grants are disbursed in a single disbursement approximately the fourth week of the semester and will be adjusted upwards if late starting classes increase award eligibility.

- Direct loans are disbursed in two equal payments at the midpoint of the selected loan period or one lump sum depending on the timing when the loan is approved.

For the latest disbursement date schedule please visit your college's financial aid website:

Award Eligibility Assumptions and Expectations:

This financial aid award is based on your most current application information accepted by the institution. Subsequent changes to your application data may decrease or increase your eligibility. You will receive a revised award letter when your eligibility changes. Any current enrollment fees or other institutional fees will be deducted from your disbursement each semester. Other fees may be deducted if you provide authorization through WebSMART.

Important - If you need to withdraw from the college, you should check with the Financial Aid Office prior to withdrawal. You may have to return a portion of the Financial Aid you received.

Selected for verification after funds are disbursed:

On occasion, a student will be selected for verification after aid has been disbursed. This may be caused by a change the student makes to their FAFSA (without our knowledge) from the Central Processing Service or National Student Loan Data Services. Students must submit all verification documents. In addition, a hold is placed on any undisbursed aid until the verification is complete. Adjustments are not made to the disbursed aid as the student was eligible for the aid at the time of disbursement. Once the verification is complete and if corrections are not required, all holds are removed and the student is eligible for the aid initially offered and/or disbursed.

If corrections are necessary and result in changes to the financial aid awarded and/or disbursed, necessary adjustments will be made. The student is responsible for repaying all aid for which they are not eligible. If the student is deemed ineligible after verification, all aid will be canceled and/or returned to the Department of Education. If the student fails to return the required verification documents within the time period as established by the school, the school cannot disburse additional funds, or originate or disburse any additional Direct Subsidized Loans. Additionally, the student must repay all federal and state funds received for the year.

Receiving aid from multiple schools at the same time:

Students can receive federal financial aid at only one college at a time per term. Students who attend multiple schools at the same time must decide which school they want to receive aid from. If a student does end up receiving aid from multiple schools within the same semester they are only eligible to receive the aid from one school and will have to return all other funds.

Cañada College canadafinancialaid@smccd.edu

College of San Mateo csmfinancialaid@smccd.edu

Skyline CollegeFinancial Aid Contact Form

Rights and Responsibilities for Financial Aid Programs

You have the right to:

Know what financial aid programs are available.

Know the priority dates for submitting applications for each of the programs available.

Be informed of financial aid policies and procedures.

The cost of attending and the policy on refunds for students who drop classes.

Know how and when you will be paid a refund (if applicable).

Know how your financial need was determined and what resources (such as your income, assets, parental contribution, and other financial aid) were considered in the calculation of need.

Request an explanation of your financial aid and how much of your financial aid eligibility has been met as determined by the Financial Aid Office.

Know what portion of your financial aid must be repaid, and what portion is gift aid or aid received from work.

Know how the Financial Aid Office determines whether you are making Satisfactory Academic Progress (SAP) and what the consequences are if you are not.

Know the terms of any loans you receive, deferment options, cancellation, forbearance rights, and repayment options.

Request reconsideration of your financial aid package if you believe a mistake has been made, or if your enrollment or financial circumstances have changed.

You have the responsibility to:

Complete all application forms accurately and submit them on time.

Provide correct information. Intentional misrepresentation of information on financial aid applications is a violation of Federal law and may be a criminal offense.

Return all documentation, verification forms, corrections, and/or new information requested by either the Financial Aid Office or the agency to which you submitted your application in a timely manner.

Read and understand all forms that you are asked to sign and keep copies of them.

Accept responsibility for all agreements that you sign.

Perform the work that is agreed upon in accepting a Federal Work-Study award in a satisfactory manner.

Be aware of refund and repayment procedures (Return of Title IV or R2T4).

Understand the SMCCCD refund policy.

Understand the SMCCCD Satisfactory Academic Progress (SAP) Policy for Financial Aid.

Understand the SMCCCD over award policy.

Understand the required 150% maximum enrollment for financial aid purposes.

Make sure your mailing address is current at all times. Failure to maintain a correct mailing address may delay receipt of your financial aid.

If you are a recipient of a student loan:

Repay all loans, including the interest on those loans.

Notify your servicer, your college Financial Aid, and Admissions and Records Offices of any changes of name, address, phone number, email address and/or enrollment status.

File all required student loan deferment or cancellation forms on time.

Report any change in the information used to determine your eligibility, including enrollment status and financial resources.

Notify the Financial Aid Office and your Federal Student Loan Servicer immediately if you withdraw from school.

Cost of Attendance

Below is a standard budget, which reflects the Cost of Attendance at the colleges in the San Mateo County Community College District. Some expenses such as Enrollment Fees, Student Representation Fees and Heath Service fees are direct costs at the college. Your actual personal expenses will vary depending on your living arrangements, personal and miscellaneous expenses, method of transportation and other factors. These expenses are limits determined by federal and state agencies with an adjustment to cost of living in the SMCCCD service area and are for your planning purposes. Fees are due to the college unless covered by waivers or financial aid. Allowances are not paid to the college but are shown for your planning purposes.

Additional costs (such as exams, licenses, required supplies) will be added to a student’s cost of attendance, if these expenses are aligned with their program of study (POS). Adjustments to the cost of attendance will not be made if student changes their POS at anytime during the academic year.

The table below is based on full time enrollment for the academic year. Enrollment fees will vary depending on the number of enrolled units. Check with your Financial Aid Office for additional information on summer terms or for less than full-time enrollment budgets.

College Costs for Aid Year 2025-2026

| In-State | ||

| COA Component | At-Home | Away from Home |

| Books & Supplies | 1,971 | 1,971 |

| Enroll/Health Fees | 1,332 | 1,332 |

| Personal Expenses | 3,564 | 3,996 |

| Housing | 11,625 | 21,410 |

| Food Allowance | 5,060 | 6,585 |

| Transportation | 1,818 | 1,989 |

| Non-Res Tuition | - | - |

| Total | $ 25,370 | $ 37,283 |

| Non-Resident | ||

| COA Component | At-Home | Away from Home |

| Books & Supplies | 1,971 | 1,971 |

| Enroll/Health Fees | 1,332 | 1,332 |

| Personal Expenses | 3,564 | 3,996 |

| Housing | 11,625 | 21,410 |

| Food Allowance | 5,060 | 6,585 |

| Transportation | 1,818 | 1,989 |

| Non-Res Tuition | 10,304 | 10,304 |

| Total | $ 35,674 | $ 47,587 |

| In-State | ||

| COA Component | BA Program At-Home | BA Program Away from Home |

| Books & Supplies | 1,971 | 1,971 |

| Enroll/Health Fees | 3,684 | 3,684 |

| Personal Expenses | 3,564 | 3,996 |

| Housing | 11,625 | 21,410 |

| Food Allowance | 5,060 | 6,585 |

| Transportation | 1,818 | 1,989 |

| Non-Res Tuition | - | - |

| Total | $ 27,722 |

$ 39,635 |

| Non-Resident | ||

| COA Component | BA Program At-Home | BA Program Away from Home |

| Books & Supplies | 1,971 | 1,971 |

| Enroll/Health Fees | 3,684 | 3,684 |

| Personal Expenses | 3,564 | 3,996 |

| Housing | 11,625 | 21,410 |

| Food Allowance | 5,060 | 6,585 |

| Transportation | 1,818 | 1,989 |

| Non-Res Tuition | 10,304 | 10,304 |

| Total | $ 38,026 | $ 49,939 |

Estimate your cost of attendance with the Net Price Calculators below.

Cañada College: https://app.meadowfi.com/canadacollege

College of San Mateo: https://app.meadowfi.com/collegeofsanmateo

Skyline College: https://app.meadowfi.com/skylinecollege

Special (Unusual) Circumstances

The process of determining eligibility for financial aid uses standard formulas and standard student budgets. The Financial Aid Office recognizes that some students have unusual or special circumstances that may not be evident in the standard process of determining eligibility.

Students with special circumstances are encouraged to contact the Financial Aid Office at their campus for review of their financial aid package based on those individual circumstances.

Students should complete the Unusual Circumstances Form and attach documentation supporting those circumstances. Income adjustment requests are based on the prior year information.

Special (Unusual) Circumstances for Families

The income information provided on the FAFSA and CADAA is for the prior-prior calendar year. What if a family’s income changes because of a loss of employment, an accident, or an illness? There may be a loss of benefits such as child support, a divorce or a disability that changes the family’s ability to pay for college.

If a family’s income will change for the coming year, you may submit a “Special (Unusual) Circumstance” application to the Financial Aid Office after you’ve filed your FAFSA or CADAA

Verification and Special Circumstances

A student/family selected for Verification by the Department of Education may not be considered for a Professional Judgement Review until that review process has been completed.

Be sure to check WebSMART for requests for any additional information needed to complete your file.

Students will also be notified through WebSMART for any resulting changes to aid eligibility.

Be sure your file is complete and all documentation has been submitted. The Financial Aid staff can use documented income changes to determine eligibility for programs by either adjusting data elements used in needs analysis calculation such as Adjusted Gross Income or increasing the Cost of Attendance as a result of K-12 school tuition costs or childcare expenses related to employment or college.

Remember, when you complete the FAFSA or CADAA, if you are dependent, a parent cannot be counted in the number in college, unless done under Special (Unusual) Circumstances.

Students wishing to request an adjustment to their FAFSA or CADAA will need to submit a completed Unusual Circumstance form to the Financial Aid Office.

Dependency Override

Federal Policy on Schools Overriding Dependency:

Federal and state guidelines require parental information to be included on the FAFSA or CADAA for a “dependent” student, which is any student who is not yet 24 as of December 31st of the award year or if under 24, any of the following DO NOT apply to them:

- Are married;

- Are an orphan;

- Are a ward of the court (Foster Youth);

- Are an emancipated minor;

- Are determined to be an unaccompanied youth who was homeless or self-supporting and at risk of being homeless;

- Are currently serving active duty for purpose other than training;

- Are a veteran;

- Are in graduate school; or

- Have dependents for which they provide more than 50% of the support

Federal and state regulation allow schools to exercise “professional judgment” in overriding a student’s dependency status when extenuating circumstances exist between the student and parent that could be characterized as abuse, neglect or abandonment and that present a risk of emotional or physical harm. The student would need to verify “unusual’ family circumstances before the Financial Aid Office can change a dependent student’s status to that of independent.

Examples of an “Unusual” Family Circumstance:

There are no absolute definitions for “unusual” family circumstances. However, examples might include abusive family situations, dysfunctional families, or families who have broken up because of alcohol or drug abuse.

A parent’s unwillingness to provide their information on the FAFSA or CADAA or otherwise financially assist a student cannot be the sole justification for a dependency override.

To request an override of your dependency status by the SMCCCD Financial Aid Office you must submit (at least) one of the following: 2023 Dependency Status Change Request Form or 2024 Dependency Status Change Request Form

Additional documentation as outlined on Section C – Submit Documents section of the Dependency Status Change Request form

Please Note: All reviews of dependency override requests are made on a case-by-case basis. Since each case is unique, additional information may be requested

Conflicting & Inaccurate Information

In reviewing application and data match information provided by the CPS (FAFSA processor), a school must have an adequate internal system to identify conflicting information—regardless of the source and regardless of whether the student is selected for verification. The school is responsible for reconciling any conflicting information that it has.

From the Federal Student Aid Handbook Application and Verification Guide, “If your school has conflicting information concerning a student’s eligibility or you have any reason to believe a student’s application information is incorrect, you must resolve the discrepancies before disbursing FSA funds.”

If a discrepancy is discovered after disbursing funds, the information must still be reconciled and appropriate action must be taken. This could result in loss of a previously disbursed financial aid award for which the student would be required to make satisfactory repayment or risk losing future federal or state aid eligibility at any school.

Applicants Selected For Verification

If any information used to calculate the Expected Family Contribution (EFC) is believed to be inaccurate or any documentation is believed to be incorrect or incomplete, adequate documentation must be required to resolve it. Any corrections regardless of magnitude or effect on the EFC must be submitted to CPS for reprocessing. In reviewing files, the application will be reviewed for other conflicting items beyond those required to be verified.

Applicants Not Selected For Verification

The Financial Aid Office must examine any documents even if they were not requested. This includes but is not limited to tax return transcripts. All comment codes on the Institutional Student Information Record (ISIR) must be resolved.

Discrepant Tax Data

Financial aid professionals are required to know whether a person is required to file a tax return, what the correct filing status for a person should be, and that an individual cannot be claimed as an exemption by more than one person.

If a financial aid applicant who has been selected for verification is required to file taxes and did not file, he or she will be required to complete the appropriate tax form before processing of the financial aid application will continue.

If it is discovered that a student and spouse, or a dependent student’s married parents, have each filed as “head of household” the individuals will be required to amend their tax returns and file under the correct filing status. It is not acceptable to simply add the two tax returns together. If both parents worked and filed “married but separate”, we must review both tax return transcripts.

Unmarried or separated parents living in the same household must submit identifying and financial information for both parents on the dependent student’s FAFSA or CADAA. If it is discovered that the parents are not married but living together and both parents work, then we will need both IRS tax return transcripts. They are unable to use the IRS Data Retrieval Tool (DRT).

IRS Publication 17: Your Federal Income Tax is an excellent resource, which may be viewed at www.irs.gov.

Other Applicant Information Received By the School

A school must have an adequate internal system to identify conflicting information that it may have, regardless of the source, such as information from the Admissions and Records Office as to whether the student has a high school diploma. At SMCCCD, if there is a conflict between the college admissions application and an ISIR regarding high school completion status, a tracking requirement is set up and the student is notified he/she must resolve the conflict.

Cal Grant Eligibility

It is necessary to review financial eligibility for all new Cal Grant recipients who have been selected for verification or who have an ISIR loaded into our system with a transaction number of 2 or greater. The purpose of this review is to ensure that changes to a student’s application do not result in the student’s information exceeding the Cal Grant income and assets ceilings.

Independent Status

If a student is below the age of 24 and answers “Yes” to one of the Dependency questions on the FAFSA, we may require documentation to verify the student’s independent status. Failure to provide documentation or parent information if later requested will halt processing of the financial aid application.

Other Discrepant Information

Financial aid funds will not be disbursed until there is resolution on all conflicting information. If the conflict involves a previous award year, it must still be resolved as long as the student is attending any college within SMCCCD.

The resolution is considered to be complete when a final determination has been made as to which information is correct and that determination has been made in writing.

Referral or Fraud Cases

If we suspect that a student, employee, or other individual has misreported information or altered documentation to fraudulently obtain federal funds, we will report our suspicions and provide any evidence to the Office of Inspector General. The contact information for OIG is:

(800) MIS-USED

Email: oig.hotline@ed.gov

Web: https://www2.ed.gov/about/offices/list/oig/hotline.html

Financial Aid Programs

|

Summary of Federal and California State Aid Programs Available to Help You Pay for Your School

|

||

|

Funding Source |

Repayment Obligation |

Additional Information |

|

Federal Pell Grant |

Grant does not require repayment |

Available to undergraduate students and those is a qualified credential program. Eligibility is determined by the federal review of FAFSA data, the EFC and a student’s enrollment status. |

|

Federal Supplemental Educational Opportunity Grant (SEOG) |

Grant does not require repayment |

For undergraduates with exceptional financial need. Funds are limited and are awarded on a first come, first served basis to Pell Grant eligible students only. March 2nd is the internal priority deadline. |

|

Federal Work-Study |

Money earned while attending school; does not require repayment |

All applicants must complete the FAFSA and should answer “Yes” to the question that asks “Are you interested in being considered for work-study?” so they can easily be identified. Funds are limited and are awarded on a first come, first served basis. March 2nd is the internal priority deadline. |

|

Federal Direct Loans |

Loans MUST be repaid |

Low-interest loans for students and parents to help pay for the cost of a student’s education. |

|

State Cal Grant A |

Grant does not require repayment |

Students with 3.00 GPA meet the basic requirements. Apply by March 2nd. There is a secondary deadline, specifically for California Community College students, September 2nd. There will be a limited number of awards for the second deadline. |

|

State Cal Grant B |

Grant does not require repayment |

Students with 2.00 GPA meet the basic requirements. Apply by March 2nd, or September 2nd (California Community College deadline). |

|

State Cal Grant C |

Grant does not require repayment |

Helps vocationally oriented students acquire marketable job skills. |

|

Community College Student Success Completion Grant |

Grant does not require repayment |

A new grant created by the California Community College Chancellor’s Office for Cal

Grant recipients attending full-time. Students must maintain and follow a current

Student Education Plan and be making Satisfactory Academic Progress. |

|

State Chafee Grant |

Grant does not require repayment |

Provides up to $4,500 annually to foster youth and former foster youth to use for college expenses. |

|

California College Promise Grant (CCPG) fee waiver |

Fee waiver does not require repayment |

Must meet eligibility requirements and be able to provide documentation. |

|

EOPS |

Grant does not require repayment |

Must meet eligibility requirements and be able to provide documentation. |

|

CARE |

Grant does not require repayment |

Must meet eligibility requirements and be able to provide documentation. |

|

Please note that general financial aid award amounts are based on full-time enrollment (12 units or more each semester) and for a full academic year. Students enrolled less than full-time may have their awards prorated and reduced. |

||

Free College

The San Mateo County Community College District and its three colleges, Cañada College, College of San Mateo, and Skyline College, are committed to reducing the financial barriers to college so you can achieve your dreams. Two levels of support in the Free College program can dramatically reduce or eliminate your out-of-pocket student fees.

Level 1: Enrollment-Fee Waiver

- What it covers: $46 per unit enrollment fee

- Who qualifies: Individuals who live in San Mateo County*, including those who are undocumented, and intending to earn a certificate or degree.

Level 2: Other Fees & Assistance (in addition to Level 1 Enrollment-Fee Waiver)

- What it covers: Health fee, student body fee, student representation fee, student union fee, inclusive access fee(s), and materials fees. You may also qualify for additional transportation, technology, and textbook support!

- Who qualifies: Students receiving the California College Promise Grant (CCPG) or those that meet the Estimated Family Contribution (EFC) cutoff (amounts listed below). EFC is determined by the completion of the Free Application for Federal Student Aid (FAFSA) or California Dream Act Application (CADAA).

EFC Cutoff Amounts for 2023-2024

- Dependent Students EFC equal to or less than $72,447

- Independent Students EFC equal to or less than $108,321

*The Enrollment-Fee Waiver does not apply to international, non-resident, or out-of-state students. Please see the FAQ below for details. For more information please visit the FAQs site.

Federal Work-Study (FWS)

Work-Study is a financial aid award that provides the student the opportunity to work and earn a portion of the funds needed to cover education or living expenses while attending school.

The benefits of work-study jobs include:

- Student oriented employers who work around your class schedule

- Income earned from Work-Study in the tax year used on the FAFSA is excluded Jobs are located on campus which makes them convenient to work in between classes

- Co-workers and district employees help you broaden contacts and your circle of friends

- 13–15 hours per week is the optimal number of hours for full-time students to work

To receive a work-study award, you should have answered ‘Yes’ to the FAFSA questions “Are you interested in being considered for work-study?”. In addition, for priority consideration, you need to have your FAFSA completed and submitted by March 2nd.

If you are a priority applicant who did not receive a Federal Work-Study Award but would still like to work, contact the Financial Aid Office to see if you might still qualify and if there are still Federal Work-Study funds available. Federal funds made available to the schools are very limited and are awarded on a first-come, first-served basis to qualified applicants. Consideration will be given to renewal students who meet all the federal conditions and requirements outlined in the Federal Student Work-Study Program. Unfortunately, due to limited available federal funds, employment in a work-study job is not guaranteed.

All students working on a SMCCCD college campus are subject to district hiring policies. Students must not begin working until they receive notification that they have been approved.

Student Loans

SMCCCD Loan Policy

In an attempt to decrease the number of student loan defaults, and lower the level of student loan indebtedness, the SMCCCD Financial Aid Offices will adhere to the following student loan policy:

While SMCCCD believes that student loans are an integral part of the federal aid programs, we are deeply concerned about student loan default and high student loan indebtedness.

Therefore, whenever possible, we will encourage students to select work-study or off-campus employment instead of student loans. In addition, we will encourage students to borrow as little as possible at the community college level where educational costs are lower than at four- year colleges and universities.

Loan Application: Case-By-Case

SMCCCD requires loan applicants to submit a written request for student loans. Forms are available online at http://www.smccd.edu/loanworkshop/. Loan requests are generally approved but could be denied or reduced on a case-by-case and year-by-year basis. Since research has shown that students who have academic progress problems are more likely to fall into default, a student's academic progress (or lack of it) will play a substantial part in the determination of the loan request.

Student Loan Empowerment Network Toolkit

Loan Approvals

Student loan requests will not be reviewed until all steps of the process are complete. This includes, but is not limited to, completing a Master Promissory Note (MPN), Entrance Counseling and the student loan repayment calculator. During the counseling process, the student will be provided with essential repayment and deferment information regarding the loan. Students whose loan requests are approved will be sent an award letter. The loan request will then be certified by the Financial Aid Office on your campus.

To be eligible for loans, students must be enrolled in an eligible program at least half-time. Students who fail to complete the minimum 6 units requirement with at least a 2.0 GPA may have their subsequent disbursement(s) cancelled.

There are Subsidized Usage Limits on Direct Subsidized loan eligibility for first time borrowers on or after July 1, 2013.

Refer to the Department of Education's Fact Sheet.

If you are applying for a one semester loan, it will be disbursed in two equal amounts-one at the beginning

of the term and one at the half way point. You must be enrolled in at least 6 units to be eligible for both disbursements.

There is a deadline for Federal Direct Loan Applications. Check with your Financial Aid Office as deadlines may vary from term to term as the academic calendars change.

Exit Counseling

When a student graduates, transfers to another college or university, drops below half-time enrollment status or otherwise leaves school, the student must complete the required Federal Direct Student Loan Exit Counseling. Exit Counseling information is emailed to every student borrower as required.

For additional information visit the website: https://studentloans.gov or contact Hyunsook Choi at choih@smccd.edu.

Payment Plans

There are two types of payment plans for federal student loans: fixed and income-driven. On a fixed repayment plan, your total principal balance is broken up into regular monthly payments that are designed to see your loans paid off within a fixed number of years. On an income-driven repayment plan, your income and family size determine your monthly payment amounts. For more information, please watch the Federal Student Aid's video guide on student repayment plans.

Student Loan Repayment Options

At the San Mateo County Community College District (SMCCCD), we recognize that student loans are sometimes necessary to help cover the cost of attending college. However, since student loans must be repaid, it's essential to borrow responsibly. Below is an overview of repayment options available to borrowers, along with tips for getting your student loan out of default.

Available Repayment Plans:

- Standard (Level) Repayment:

This plan divides your principal and interest into equal monthly payments, typically over 10 years. Monthly payments begin at a minimum of $50. Learn more about Standard Repayment. - Income-Driven Repayment (IDR) / Income-Based Repayment (IBR):

Under this plan, your monthly federal loan payments are capped based on your income and family size. Additionally, loan forgiveness is available for borrowers who remain in the program for 20 or more years (or 10 years for those working in government, non-profit, or public service). The lower your income, the lower your monthly payment will be. Learn more about IDR/IBR. - Pay As You Earn (PAYE):

PAYE is available to borrowers who have a high student loan debt relative to their income. It caps monthly payments at 10% of discretionary income and offers loan forgiveness after 20 years of payments. Most Direct Loans (excluding Direct PLUS Loans for parents and Direct Consolidation Loans) are eligible. PAYE is available to borrowers who first took out loans after October 1, 2007, and took out a loan after October 1, 2011. Learn more about PAYE. - Extended Repayment Plan:

This plan allows you to extend your repayment period beyond 10 years, lowering your monthly payment amount. Learn more about Extended Repayment.

Tips for Getting Your Student Loan Out of Default

If you are a borrower with a defaulted loan, it is important to act quickly. Default generally occurs on federal student loans when payments are missed for 270 days. During the delinquency period, the lender attempts to contact the borrower. If the borrower is unreachable or does not make payments, the loan will be placed in default. Avoiding default is crucial, as student loans typically cannot be discharged through bankruptcy.

Consequences of Default:

- Full loan balance due immediately: Both the principal and interest.

- Wage garnishment and withholding of federal or state tax refunds.

- Social Security benefits may be withheld.

- Additional charges, late fees, and collection costs are added to the loan balance.

- Lawsuits may be initiated by the lender.

- Ineligibility for further student aid until the loan is resolved.

- Damaged credit score, which could affect your ability to secure future loans, mortgages, or car financing.

- Loss of eligibility for loan deferments (such as for in-school status, unemployment, etc.).

How to Get Out of Default:

To regain eligibility for federal student aid, borrowers in default must make satisfactory repayment arrangements with the loan holder. This can be achieved by making at least six voluntary, on-time payments over six consecutive months.

Another option is loan rehabilitation, which helps eliminate the default from your credit report and restores eligibility for federal student aid. To rehabilitate your loan, you must:

- Contact the loan holder to begin the rehabilitation process.

- Make 9 full voluntary payments within 20 days of the due date over a period of 10 consecutive months.

In some cases, borrowers may negotiate a settlement with the collection agency. While this can reduce the total amount owed, it will not remove the default status from your record. Settling may also allow you to waive collection charges.

Lastly, loan consolidation is a viable option. The Department of Education offers a Direct Consolidation Loan process that can assist defaulted borrowers. Visit StudentLoans.gov to apply for consolidation.

Additional Resources for Payment Options:

We encourage borrowers to explore their options and take proactive steps toward managing their student loan repayment effectively.

Emergency Loans

Emergency Loans are temporary, short term loans arranged on a case by case basis to qualifying students. These loans are made through the Financial Aid Office at the SMCCCD College that is or will be processing the student’s financial aid award.

Your Financial Aid Office has an Application for Short Term Emergency Loan. Generally, these loans are for 30 days (or less). No interest is charged on these short-term loans. For financial aid recipients, repayment is due upon receipt of financial aid funds from the school.

Parent PLUS Loan

Parents of dependent students may borrow a Federal Direct Parent PLUS loan to help pay for the cost of a student’s education. An SMCCCD Parent PLUS Loan application is available upon request. If interested, contact your student’s college financial aid office.

Cal Grants

TWO FORMS, TWO STEPS

Submit the FAFSA or CADAA as soon as possible on or after October 1st, and no later than March 2nd.

Submit your GPA verification form by March 2nd.

More information at https://www.csac.ca.gov/cal-grants.

A Cal Grant is money for college you don’t have to pay back. To qualify, you must meet the eligibility and financial requirements as well as any minimum GPA requirements. Cal Grants can be used at any University of California, California State University or California Community College, as well as qualifying independent and career colleges or technical schools in California.

There are 3 kinds of Cal Grants:

Cal Grant A helps pay for tuition and fees at four-year colleges. The Cal Grant A does not cover

your tuition and fees while attending a community college, however your award eligibility

will be held in reserve for up to two years until you transfer to a four-year college.

*If you are attending a baccalaureate program at a community college, you may receive

funds to help pay for your tuition and fees. Please contact your Financial Aid Office

at the college for more details.

Cal Grant B provides a living allowance of up to $1,656, in addition to tuition and fee assistance

after the first year, at a two- or four-year college.

Cal Grant B Foster Youth Award

On July 1, 2018 California expanded the Cal Grant Program to allow students who are

current and former foster youth to be eligible for increased Cal Grant eligibility.

• Foster youth students may renew their Cal Grant B awards for the equivalent of eight

years of full-time attendance in an undergraduate program.

• Foster youth students have until their 26th birthday to apply for the Cal Grant

High School Entitlement Award.

• Foster youth students attending a California Community College can apply for a High

School Entitlement award through September 2nd (rather than March 2nd).

Cal Grant C assists with the costs of a technical or career education and provides up to $1,094 for books, tools and equipment.

Students with Dependent Children

Cal Grant recipients who have a dependent child under the age of 18, and who are providing more than 50% of their support, are eligible to receive an increased award. For full time attendance, 12 or more units, a Cal B recipient can receive up to $3004 per semester, or $6008 per year. A Cal C recipient is eligible for $2000, per semester attending full time, or $4000 per year. If you are taking fewer units, the amount will be prorated down.

Further information is available at https://www.csac.ca.gov/cal-grants

Cal Grant Grade Levels:

Associate and Eligible Certificate Program Grade Levels:

|

# of Credits/Hours |

Grade Level |

|

<30 |

1 |

|

30 + |

2 |

The grade level is tracked on the FAFSA application for reporting.

ESL courses will be considered when determining the grade level for the Cal Grant programs.

The Cal Grant Application Process

FAFSA and CADAA information is sent to the California Student Aid Commission (CSAC). Your confirmation from the FAFSA (Student Aid Report or SAR) will be emailed to you at the email listed on the FAFSA Application. There is a link in that email which will let you confirm the release to CSAC.

All students need to submit Grade Point Average verification to CSAC. Most colleges and high schools do this automatically for their students. You must confirm whether your school will file your GPA, otherwise obtain the Cal Grant GPA Verification form at www.csac.ca.gov, and have your high school or college verify your GPA before mailing it to CSAC.

Skyline College BA RPTH Pilot Program Grade Level Policy and Procedure:

In order for a student to meet Entrance Eligibility into the BA RPTH program at Skyline College they must meet the following:

Student Entrance Eligibility

Who is eligible to apply:

- Students currently enrolled in AS Respiratory Care program at Skyline College and intend to continue to BS Respiratory Care program

OR

- New graduates from other programs who have completed an accredited Respiratory Care program equivalent to an AS in Respiratory Care and are California licensure eligible

OR

- Respiratory Care Practitioners who have completed an accredited Respiratory Care program equivalent to an AS in Respiratory Care and are California licensure eligible

AND

- Completed minimum 30 units of the CSU/IGETC General Education pattern

Eligibility Process Review:

- Once the program application is submitted along with transcript(s), Allied Health counselors reviews the coursework and determines the eligibility for each applicant.

- Upon acceptance into the Bachelor’s Degree program, each student is required to submit

the following documentations:

- Submit official transcripts from all institutions

- Provide proof of RT credentials

Lastly, students submit TES request. The progression for grade level is as follows:

The progression for grade level is as follows:

|

# of Credits/Hours |

Grade Level |

|

<30 |

1 |

|

30 + |

2 |

|

60 + |

3 |

|

90 + |

4 |

Web Grants for Students lets you track your Cal Grant 24/7

WebGrants for Students provides the resources, information and tools needed to assist with the college financial aid process. WebGrants for Students allows you to manage your Cal Grant and/or Chafee Grant account(s) online – you can view updates, make school or address changes, make corrections, post leave-of- absence requests and complete forms at https://mygrantinfo.csac.ca.gov/logon.asp.

Cal Grant Self Service for Students

Financial aid applicants are able to check the status of their Cal Grant at https://mygrantinfo.csac.ca.gov/logon.asp. FAFSA and CADAA filer information is automatically forwarded to the California Student Aid Commission. It can take two to three weeks from the time the FAFSA was filed for your information to post at this web site.

Chafee Grant for Foster Youth:

The California Chafee Grant Program provides up to $5,000 annually to foster youth and former foster youth to use for college expenses. You may also qualify for other on campus resources such as EOPS, Health Center, Psychological Services, and Career Center. To qualify, a student must have been in foster care between their 16th and 18th birthday and not have reached their 26th birthday as of July 1st of the award year. Eligible students may have been foster youth in another state and now live in California. This is a need-based grant awarded to students enrolled in at least 6 units. Applications are available online at www.chafee.csac.ca.gov or call 888-224-7268, option #3. Students must apply for FAFSA or CADAA.

Off Campus Resources for Foster Youth

Casey Family Programs - http://www.casey.org/Resources/

California Youth Connection - http://www.calyouthconn.org/

AB 540 and DACA Students

If you are an undocumented or under-documented student, attended at least three years of high school in California and graduated from a California high school or received its equivalent, or meet expanded eligibility by completing a combination of three years of high school, adult school or community college, you may qualify for in-state tuition rates at California’s public colleges. Cal Grants and privately funded scholarships may be considered when you transfer to a four-year California college. Questions regarding AB540 enrollment eligibility should be directed to your college’s Admission and Records Office.

If you filed an application for permanent residency at least one year before enrolling in college, you may already be eligible for in-state tuition rates and California state aid - contact your college’s Admissions and Records Office. Any student, who meets all of the following requirements, shall be exempt from paying nonresident tuition at the California Community Colleges, the University of California, and the California State University (all public colleges and universities in California).

What is DACA?

DACA, or Deferred Action for Childhood Arrivals, grants consideration for deferred action to certain people who came to the United States as children and meet several key guidelines. An individual who has received deferred actions, or DACA status, is authorized by the Department of Homeland Security (DHS) to be present in the United States, and is therefore considered by DHS to be lawfully present during the period deferred action is in effect. However, deferred action does not confer lawful status upon an individual, nor does it excuse any previous or subsequent periods of unlawful presence.

For more information about DACA, please refer to: http://www.uscis.gov/humanitarian/consideration-deferred-action-childhood-arrivals-process/frequently-asked-questions

What is AB 540 and AB 2000 and SB 68?

AB 540 is a state law that exempts certain students who are not residents of California from paying nonresident tuition at California Community Colleges and California State Universities. The current SMCCCD rate is $46 per unit. Two additional laws were passed that expand eligibility for AB 540 to more students.

Beginning January 1, 2015 AB 2000 amends the school attendance requirement of AB 540 and designates that if a student has not attended a California High School for at least three years, that portion of the eligibility criteria may be replaced with the following:

Attainment of three years’ worth of high school credits from a California High School (equivalent to 3 or more years of full-time high school coursework), and

A total of 3 or more years of attendance in California elementary or secondary schools, or a combination of those schools (the years do not have to be sequential).

Who is Eligible?

Starting in January of 2013 AB 540 & AB 2000 students will also be able to apply for:

Certain scholarships which require BOG fee waiver eligibility

Institutional financial aid like EOPS grants & fee waivers and community college BOG fee waivers

Requirements:

The student must have attended a high school (public or private) in California for three or more years.

The student must have graduated from a California high school or attained the equivalent prior to the start of the term (for example, passing the GED or California High School Proficiency exam).

Students who are non-immigrants (for example, those who hold F [student] visas, B [visitor] visas, etc.) are not eligible for this exemption.

The student must file an exemption request including a signed affidavit with the college that indicates the student has met all applicable conditions described above. Student information obtained in this process is strictly confidential unless disclosure is required under law.

Nonresident students meeting the criteria will be exempted from the payment of nonresident tuition, but they will not be classified as California residents. They continue to be “nonresidents.”

Additional Resources

Extended Opportunity Programs and Services (EOPS): EOPS is a student support program for educationally and economically disadvantaged students. It is designed to provide opportunities in higher education for students with academic potential that historically would not have attended college.

CalWORKs: CalWORKs (California Work Opportunities and Responsibility to Kids) is a state funded Welfare-to-Work Program designed to help individuals on public assistance become self-sufficient. The program includes education, training and support services, as well as employment opportunities related to the individual goal of each participant.

Dream Center: Are you concerned about immigration and undocumented community issues? The Dream Center can help you with issues like AB 540 admissions, DACA, the California Dream Act and more. We are here to answer questions and provide support in a welcoming and safe space. Connect with a representative located on each campus who can answer many immigration questions or connect you with an Ally on campus.

Promise Scholars Program: The Promise Scholars Program provides full-time students a full scholarship through completion of their AA/AS or certificate program, text book assistance, transportation vouchers, and academic and professional support. The program is open to first-time college students who can commit to attending a SMCCD school full-time (12 units minimum per semester, with 15 units highly encouraged).

The intention of the Promise Scholars Program is to accelerate your path toward achieving your educational goals, whether you hope to earn a certificate or an associate degree. This is more than a scholarship. The program aims to provide all Scholars a supportive, engaged, and inclusive community – a home on campus. We expect all students in the program to regularly participate in counseling, career and professional development, and utilize the program’s academic support.

Law Enforcement Personnel Dependents Grant: This grant is available to dependents of California law enforcement officers who were killed or totally disabled in the line of duty. These need-based grants range from $100 to $9,873 a year, up to four years, and may be used to attend any California college.

AmeriCorps: By becoming a volunteer with AmeriCorps, you will receive an education award of up to $5,730 (prorated according to unit level) each year for up to two years. This program provides full-time educational awards in return for work in community service. Funds are requested through the Financial Aid Office. For more information, call 1-800-942-2677 or go to http://www.nationalservice.gov/.

U.S. Department of Veteran’s Affairs: If you are a veteran or you are the dependent of a veteran, Veteran’s Educational Benefits may be available to you. Inquire on campus for more details. For more information, call 1-888-442-4551 or go to www.benefits.va.gov/gibill/.

Armed Forces: The Army, Navy and Air Force award college scholarships based on physical aptitude and merit to students who will serve at least four years on active duty after graduation. U.S. Coast Guard: The Coast Guard, part of the Department of Homeland Security, can be reached at (877) NOWUSCG.

Support for Native Americans: Members or close descendants of a federally recognized American Indian tribe or Nation may be eligible for grants to help pay for college. To learn more, contact the Office of Indian Education Programs go to http://www2.ed.gov/about/offices/list/oese/oie/index.html (FAFSA application is required)

IRS Tax Benefits: The Lifetime Learning Credit is available for college juniors, seniors, graduate students, and working Americans who are pursuing learning to upgrade skills. The credit is also available for students who have already completed the first two years of general education at a community college, and who are attending more than part-time to improve or upgrade job skills.

Financial Aid Vocabulary

Award Notification Letter: A letter notifying financial aid applicants of the types and amounts of aid offered, as well as the responsibilities and conditions of each award. The letter will include the method and dates of payment.

California Aid Report (CAR): Correspondence you receive from the California Student Aid Commission regarding your Cal Grant eligibility after you file the FAFSA and GPA Verification form.

Cost of Attendance (COA): The total estimated cost of college for the school year, also referred to as the student budget; includes tuition, fees, books, supplies, transportation, food, housing, and personal expenses. Some components of the COA are obligations to the school and others are estimates for planning purposes.

For example, a student has a food allowance but does not pay the institution for food.